Guide to Recessions

by Justin J. Long CFP® on Sep 22, 2022 12:00:00 AM

When is the next U.S. recession and how should you prepare for it?

Recession has been a huge topic of conversation the last few months with clients, friends, and family. I wanted to take a moment and go through some of the recessionary pressures and indicators we are seeing, and some that we are not and give everyone an idea of where things are.

As most of you know here at Diazo, we have an internal Investment Committee with our 2 Chartered Financial Analysts®, as well as the rest as the rest of the IAS/Diazo brain trust consisting of a plethora of industry experience as well as different backgrounds, from equity analysts to bond and economic analysts.

We also partner with some of the largest industry names in the financial services world. These names include our custodians (where we manage clients’ money – Charles Schwab and Fidelity Investments, money managers like Blackrock and Capital Group (American Funds), and bond providers like Dodge and Cox as well as Baird.

Much of the following info was pulled from these sources and gives great insight to the current economic situation along with previous recessions.

If you have any questions about this, please feel free to book some time for a call on my calendar here.

When is the next recession?

That's one of the questions we hear most often, especially now as the Federal Reserve aggressively hikes interest rates to rein in inflation at 40-year highs. It appears more and more likely the U.S. will enter a recession by early 2023, if it hasn't already. Compared to the 2008 global financial crisis, although the full extent of any downturn won't be known for some time, we are optimistic any recession will be brief with limited damage to long-term economic prospects.

Recessions can be complicated, misunderstood, and downright scary. But, most of all, they're hard to predict, as Paul Samuelson - the first American to win the Nobel Prize in Economics - wryly noted in the 1960s. So rather than predicting the exact date of the next recession, this guide will offer perspectives on the following questions:

- What factors have contributed to previous recessions?

- How have equities performed during past contractions?

- What are the most consistent economic indicators to watch?

- How close is the next recession?

- What can investors do to prepare?

Let's start with the most basic question: What causes recessions?

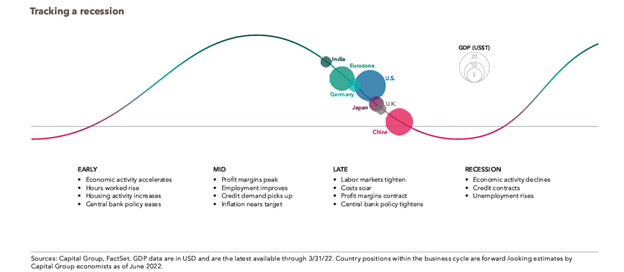

A recession is commonly defined as at least two consecutive quarters of declining GDP (gross domestic product) after a period of growth, although that is not enough on its own. The National Bureaus of Economic Research (NBER), which is responsible for business cycle dating, defines recessions as “a significant decline in economic activity spread across the economy, lasting more than a few months, normally visible in real GDP, real income, employment, industrial production and wholesale-retail sales.” In this guide, we will use NBER’s official dates.

Past recessions have occurred for many reasons, but typically are the result of economic imbalances that, ultimately, need to be corrected. For example, the 2008 recession was caused by excess debt in the housing market, while the 2001 contraction was caused by an asset bubble in tech stocks. An unexpected shock such as the COVID-19 pandemic, widespread enough to damage corporate profits and trigger job cuts, also can be responsible.

How long do recessions last?

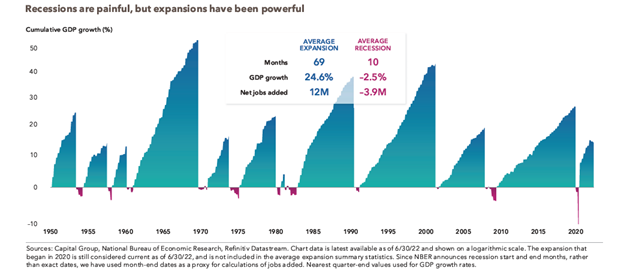

The good news is recessions generally haven’t lasted very long. Our analysis of 11 cycles since 1950 shows recessions have persisted between 2 and 18 months, with the average spanning about 10 months. For those directly affected by job loss or business closure, that can feel like an eternity. But investors with a long-term investment horizon would be better served looking at the full picture.

Recessions are relatively small blips in economic history. Over the last 70 years the U.S. has been in official recession less than 15% of all months. Moreover, the net economic impact from these slowdows has been relatively small. The average expansion has increased economic output by almost 25%, whereas the average recession reduced GDP by 2.5%. Equity returns can even be positive over the full length of the contraction since some of the strongest stock rallies have occurred during the late stages of recession.

What happens to the stock market during a recession?

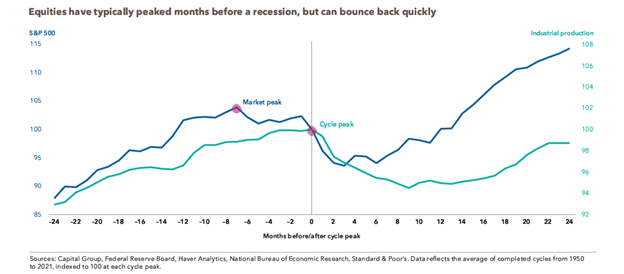

The exact timing of a recession is hard to predict, but it’s still wise to think about how one could affect your allocation and portfolio. Bear markets (market declines of more than 20%) and recessions have often overlapped – with equities leading the economic cycle by six to seven months on the way down and again on the way up.

Still, aggressive market timing moves, such as shifting an entire portfolio into cash, can backfire. Some of the strongest returns can occur during the late stages of an economic cycle or immediately after a market bottom.

A dollar cost averaging strategy, in which investors systematically invest equal amounts at regular intervals no matter the market’s movements, can be beneficial in down markets. This approach not only allows investors to purchase more shares at a lower price but positions them to benefit when the market eventually rebounds. Regular investing does not ensure a profit or protect against loss. Investors should consider their willingness to keep investing when share prices are declining.

What economic indicators can warn of a recession?

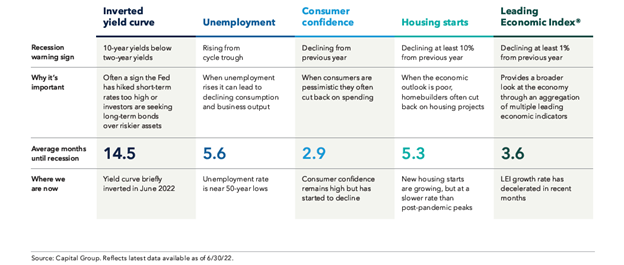

Wouldn’t it be great to know ahead of time when a recession is coming? Despite Paul Samuelson’s warning about the hazards of making predictions, there are some generally reliable signs worth watching closely in a late-cycle economy.

Many factors contribute to a recession, and the main causes often change. Therefore, it’s helpful to look at several different aspects of the economy to better assess where excesses and imbalances may be building. Keep in mind that any indicator should be viewed more as a mile maker than a distance-to-destination sign.

What is an inverted yield curve?

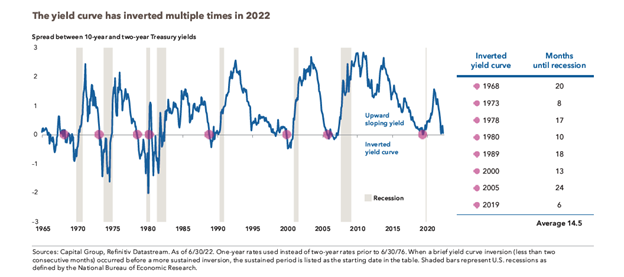

An inverted yield curve may sound like an elaborate gymnastics’ routine, but it has been one of the most accurate and widely cited recession signals. The yield curve inverts when short-term rates are higher than long-term rates. This market signal has preceded every U.S. recession over the past 50 years. Short-term rates typically rise during Federal Reserve tightening cycles. Long-term rates can fall when there is high demand for bonds. An inverted yield curve is a bearish sign because it indicates that many investors are moving to the perceived safety of long-term government bonds rather than buying riskier assets.

The yields on two-year U.S. Treasuries were higher than the yields on ten-year U.S. Treasuries briefly in April and June, a slight inversion, before dropping to new cycle lows in July. Other parts of the curve – such as two-year and five-year yields – have also turned negative at times this year. It wouldn’t be surprising to see further inversion should the Fed continue to boost short-term rates and the economic outlook darkens. However, an inverted yield curve is not cause for immediate panic, as there typically has been a significant lag (14.5 months on average) before the start of a recession.

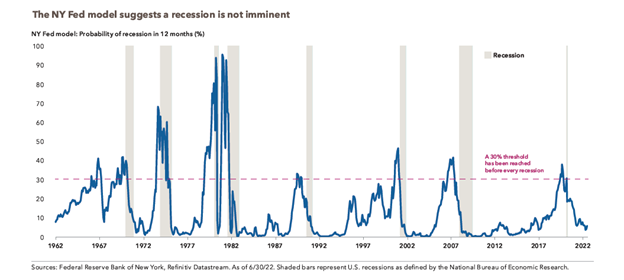

How close are we to the next recession?

While it may feel like we are already in one, we believe an official recession is unlikely until later this year or early 2023. Despite the impact that high inflation has on consumer sentiment and corporate earnings, a strong labor market continues to support the economy in the near term.

The exact timing will likely depend on the pace and magnitude of the Fed’s moves, along with outside factors the Fed cannot predict or control. It is hard to see a clear path to bring inflation to the Fed’s 2% target without pushing the economy into recession. Federal Reserve Chairman Powell has committed to pushing rates higher to combat escalating wages and prices at the expense of some jobs, causing slack in the labor market at a higher unemployment rate. Given labor market disruptions caused by the pandemic, the unemployment rate may need to rise to 5% or 6% before wage growth starts to moderate. This could make a recession very difficult to avoid in 2023.

Geopolitical shocks – such as an escalation of the war in Ukraine – or the consequence of a recession overseas are even harder to predict but could quicken the timeline for a U.S. based recession.

How should you position your stock portfolio for a recession?

We’ve already established equities often do poorly during recession, but trying to time the market by selling off your entire portfolio usually has consequences. So should you as an investors do nothing? Certainly not.

To prepare, investors should take the opportunity to review their overall asset allocation, which may have changed significantly during the bull market, to ensure their portfolio is balanced and diversified. Consulting with a fiduciary financial adviser can help immensely since these can be emotional decisions for investors.

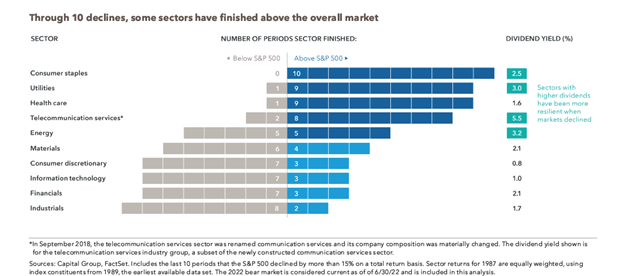

Not all stocks respond the same during periods of economic stress. In the 10 largest equity declines between 1987 and 2022, some sectors held up more consistently than others - usually those with higher dividends such as consumer staples and utilities. Dividends can offer steady return potential when stock prices are broadly declining.

Growth oriented stocks can still have a place in the portfolio, but investors may want to consider companies with strong balance sheet, consistent cash flows and long growth runways that can withstand short-term volatility.

Even in recession, many companies remain profitable. Focus on specific companies with products and service people will continue to use every day such as telecom, utilities and food manufacturers with pricing power while maintaining broad diversification.

How should you position your bond portfolio for a recession?

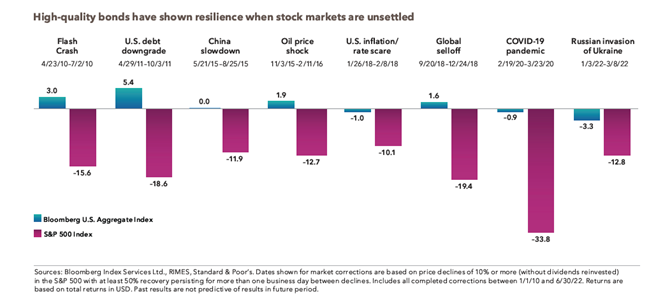

Fixed income is often key to successful investing during a recession or bear market. That’s because bonds can provide an essential measure of stability and capital preservation, especially when equity markets are volatile.

The market selloff of 2022 was unique in that many bonds did not play their typical safe-haven role. But in seven previous market corrections, bonds – as measured by the Bloomberg Aggregate Index – rose four times and never declined more than 1%.

Achieving the right fixed income allocation is always important. But with the U.S. economy entering a period of uncertainty, it’s especially critical for investors to focus on core bond holdings that can provide balance to their portfolios. Investors don’t necessarily need to increase their bond allocation ahead of a recession but should review WHAT they own in their fixed income allocation with a financial fiduciary. This will help to ensure it is positioned properly to provide diversification from equities, income, capital preservation and inflation protection – what are widely considered the four key roles of fixed income in a well-diversified portfolio.

How should you position your bond portfolio for a recession?

- Stay calm and keep a long term prospective

- Maintain a balanced and properly diversified portfolio

- Consider balancing equity portfolios with a mix of dividend-paying companies and growth focused stocks

- Choose investments with a strong history of weathering market declines

- Use high quality fixed income to help offset market volatility

- Speak with a fiduciary financial adviser to game plan your goals

Guide to Recessions: Key Takeaways—

- Recessions are a natural and necessary part of every business cycle-

They occur when economic output declines after a period of growth.

- Recessions have been infrequent-

The U.S. has been in official recession for less than 15% of all months since 1950.

- Recession have been relatively short-

Recessions have ranged from 2 months to 18 months, with the average lasting about 10 months.

- Recessions have been less impactful compared with expansions-

The average recession leads to a contraction of 2.5% in GDP. Expansions grow the economy about 25% on average.

- An inverted yield curve has preceded each of the last eight recession by an average of 14.5 months-

It’s one of the most consistent signs that a slowing economy has reached its tipping point.

- Equities have typically peaked seven months before the economic cycle-

They also often rebound before a recession officially ends

- Some Equity sectors have held up better than others during severe declines-

Consumer staples topped the S&P 500 index during each of the last 10 major market declines

- A core bond portfolio can provide stability during recessions-

When stock markets decline sharply, high-quality bonds have shown resilience.

Share this

Diazo Insights

We’re not just here to manage your wealth. We’re here to help you understand how your money is being invested. Whether you’re figuring out how to limit your tax burden after an inheritance or looking at the costs of launching a company, stay up-to-date with the latest articles, videos, and research on investment management, tax planning, and more. Education is empowerment, and we’re here to give you a boost.

- March 2026 (1)

- January 2026 (1)

- December 2025 (1)

- November 2025 (1)

- September 2025 (1)

- August 2025 (1)

- July 2025 (1)

- June 2025 (1)

- May 2025 (1)

- January 2025 (1)

- October 2024 (1)

- September 2022 (1)

- July 2022 (1)

- June 2022 (2)

- April 2022 (1)

- March 2022 (2)

- February 2022 (1)

- January 2022 (2)

- December 2021 (1)

- November 2021 (1)

- October 2021 (1)

- August 2021 (2)

- July 2021 (3)

- June 2021 (1)

- April 2021 (1)

- December 2020 (1)

- September 2020 (1)