by Justin J. Long CFP® on Aug 11, 2021 12:00:00 AM

Why are the headlines terrible?

Because the media loves drama. This is not news to you or me or anyone who pays attention. The 24-hour news cycle is there to whip up emotions and keep us glued to the latest "BREAKING NEWS."

So, what’s behind the noise and should we worry?

Before we jump into unpacking the news, let’s take a moment and remind ourselves of how far we’ve come since the pandemic began.

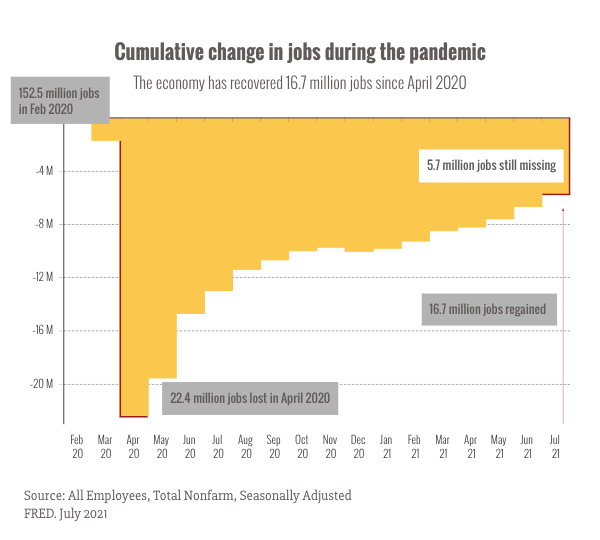

You can see it right here in this chart:

We've recovered the vast majority of jobs lost since the bottom of the pandemic's disruption last April. The economy is still missing several million jobs to regain pre-pandemic levels, but we've made up a lot of ground, and jobs growth is still strong.1

In fact, there are more job openings right now than job seekers to fill them.2

But there's an important caveat to the chart above.

The monthly jobs report is what economists call a "lagging" indicator, meaning that it's telling us where the economy was, not where it's going.

To figure out what might lie ahead, economists turn to "leading" economic indicators that help forecast future trends.

So, what are the leading indicators telling us about the economy?

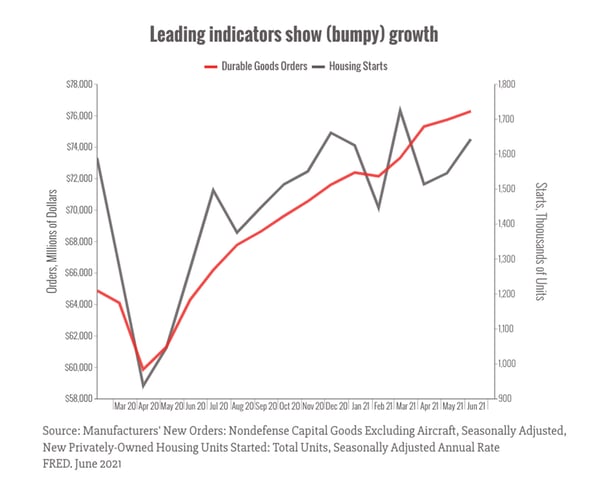

A couple of the most popular indicators are manufacturing orders for long-lasting (durable) goods, since companies don't like to order expensive equipment unless they expect to need soon.

Another one is groundbreaking (starts) on new houses, which indicate how much demand builders expect for housing.

Let's take a look: Both indicators suggest continued (if bumpy) growth. Now, those are just two sectors, and we want to be thorough, so let's take a look at a composite.

Both indicators suggest continued (if bumpy) growth. Now, those are just two sectors, and we want to be thorough, so let's take a look at a composite.

The Conference Board Leading Economic Index (LEI) gives us a quick overview each month of several indicators.

It increased by 0.7% in June, following a 1.2% increase in May, and a 1.3% increase in April, showing broad, but slowing growth.3

What does that tell us? That the economy still has legs.

Will the delta variant derail the recovery?

A serious slowdown due to the delta variant seems unlikely, but we could potentially see a bumpy fall, especially in vulnerable industries and areas with surging case counts.

There's also some potentially good news about the delta variant that we can take from other countries.

India and Great Britain both experienced delta-driven surges earlier this summer.4

And what happened?

A steep and scary rise in case counts and hospitalizations...followed by a rapid decline.

It seems that these fast-moving delta waves might burn themselves out.

Unfortunately, these surges come with a painful human cost to patients, overburdened medical staff, communities, and families.

But, if this pattern holds true in the U.S., it doesn't appear that the economic impact will be heavy enough to derail the recovery.

All this to say, it's clear that the pandemic is still not over.

But we've come such a long way since the darkest days of 2020 and the road ahead still seems bright (if a little potholed).

Please remember to take panicky headlines with a shaker or two of salt.

I'm here and I'm keeping watch for you.

Have questions? Please reach out.

P.S. The bipartisan infrastructure deal is still making its way through Congress, and we don't yet know what the final details will look like. The Democrat-led infrastructure deal is also in the works, but we're not likely to see serious movement until the fall. I'll keep updating you as I know more.

1 https://www.cnbc.com/2021/08/06/jobs-report-july-.html

2 https://www.cnbc.com/2021/08/07/there-are-about-1-million-more-job-openings-than-people-looking-for-work.html

3 https://conference-board.org/pdf_free/press/US%20LEI%20PRESS%20RELEASE%20-%20July%202021.pdf

4 https://nymag.com/intelligencer/2021/08/the-u-k-s-delta-surge-is-collapsing-will-ours.html

We’re not just here to manage your wealth. We’re here to help you understand how your money is being invested. Whether you’re figuring out how to limit your tax burden after an inheritance or looking at the costs of launching a company, stay up-to-date with the latest articles, videos, and research on investment management, tax planning, and more. Education is empowerment, and we’re here to give you a boost.

(702) 745-1800

info@diazowealth.com

Diazo LLC is registered as an investment adviser and only conducts business in states where it is properly registered or is excluded from registration requirements. Information presented is for educational purposes only and should not be regarded as a complete analysis of any topics discussed or as personalized financial advice.

Wealthtender and Diazo Wealth are independent and unaffiliated organizations. Please refer to the important disclosures contained in the Wealthtender Advisor Profile (the "Profile") for information regarding the ratings, reviews, and other information regarding Diazo Wealth that is included in the Profile.

Copyright © 2024 Diazo LLC

Website designed by Goodwood Consulting